What Does Bankruptcy Melbourne Do?

Table of ContentsSome Of Bankruptcy MelbourneThe Best Strategy To Use For File For BankruptcyAn Unbiased View of Insolvency MelbourneAll About BankruptcyAll About Insolvency Melbourne

What occurs to your home depends on whether you file chapter 7 or phase 13 bankruptcy. If you're not sure which alternative is best for your scenario, see "Bankruptcy: Phase 7 vs.Chapter 7Chapter 7 bankruptcy is often called commonly bankruptcy because insolvency since likely need to require off some of your assets to possessions at least a the very least of what you owe.

Some Known Factual Statements About Bankruptcy Melbourne

Chapter 13With a phase 13 insolvency, you don't need to stress over requiring to liquidate any one of your home to please your debts. Instead, your financial obligations will be rearranged to ensure that you can pay them off partially or in complete over the next three to 5 years. Maintain in mind, though, that if you do not conform with the layaway plan, your creditors may be able to go after your possessions to satisfy your financial debts.

That claimed, the two sorts of bankruptcy aren't dealt with similarly. Because phase 7 bankruptcy completely gets rid of the financial debts you include when you submit, it can remain on your credit score record for up to one decade. While chapter 13 insolvency is additionally not optimal from a debt perspective, its configuration is watched more favorably since you are still settling a minimum of several of your financial obligation, and also it will stay on your credit history record for approximately 7 years.

There are some lenders, nonetheless, who specifically deal with individuals that have gone through bankruptcy or other difficult debt occasions, so your options aren't completely gone. The credit rating racking up designs favor brand-new info over old information. So with favorable credit score behaviors post-bankruptcy, your credit history can recover over time, also while the bankruptcy is still on your credit rating record.

What Does Liquidation Melbourne Mean?

Personal bankruptcy process are submitted in a system called Public Access to Court Electronic Records, or PACER for brief. Generally, it's even more typical for lawyers and also financial institutions to use this system to look up details about your insolvency. However anyone can register and inspect if they desire to.

This solution is totally free and can increase your credit report quickly by utilizing your own positive settlement background. It can also aid those with poor or limited debt circumstances. Various other services such as debt repair work might cost you approximately thousands and just aid get rid of inaccuracies from your credit score record.

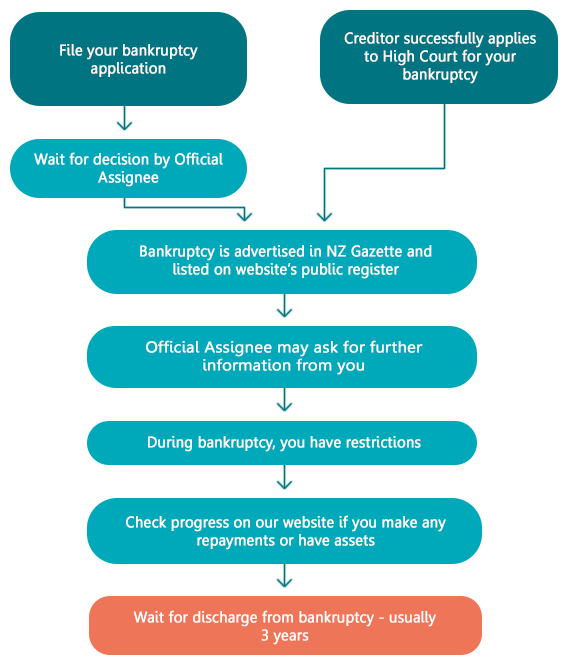

Personal bankruptcy is a legal process where someone who can't pay their financial obligations can obtain relief from an obligation straight from the source to pay some or every one of their financial debts. You must obtain help from a monetary coaching solution bankruptcy attorneys cheap near me and also legal recommendations before using for bankruptcy. Coming to be bankrupt has major consequences and also there might be various other choices available to you.

Get This Report on Insolvency Melbourne

AFSA has information concerning your responsibilities while bankrupt. There are significant repercussions to coming to be insolvent, including: your bankruptcy being completely recorded on the your insolvency being detailed on your credit record for 5 years any assets, which are not safeguarded, potentially being marketed not being able to take a trip overseas without the created consent of the personal bankruptcy trustee not being able to hold the position of a director of a business not having the ability to hold particular public settings being restricted or prevented from proceeding in some trades or occupations your capability to obtain cash or get things on credit scores being influenced your capacity to obtain rental lodging your ability to obtain some insurance policy agreements your capacity to access some solutions such as energies as well as telecommunication solutions.

You're allowed to maintain some properties when you become bankrupt (Bankruptcy Melbourne).

They might enable you to remain to pay the home mortgage payments so that you can continue to live in the home. They might likewise require the sale of the residential or commercial property. It is extremely crucial to obtain lawful advice before applying for insolvency if you have a home. Financial debts you should pay despite insolvency You will still have to pay some financial obligations despite the fact that you have ended up being bankrupt.

Personal Insolvency Fundamentals Explained

These consist of: court enforced penalties and also penalties maintenance debts (consisting of youngster assistance financial obligations) pupil support or supplement lendings (aid College Finance Program, HECS Greater Education And Learning Contribution System, SFSS Student Financial Supplement System) financial debts you incur after you come to be bankrupt unliquidated financial obligations (eg cars and truck accidents) where the quantity payable for the damage hasn't been fixed prior to the date of bankruptcythere are some exemptions financial obligations incurred by fraudulence debts you're reliant pay because of misbehavior (eg compensation for injury) where the total up to be paid has not yet been fixed (unliquidated damages)there are some exemptions to kaplan bankruptcy firm llc this.

It doesn't matter if you're bankrupt at the start or come to be insolvent during the situation. You must inform the court, as well as everybody included in your situation if you're bankrupt or in an individual bankruptcy arrangement.